The Endurys Approach to Strategic Life Insurance

The Endurys Approach to Strategic Life Insurance

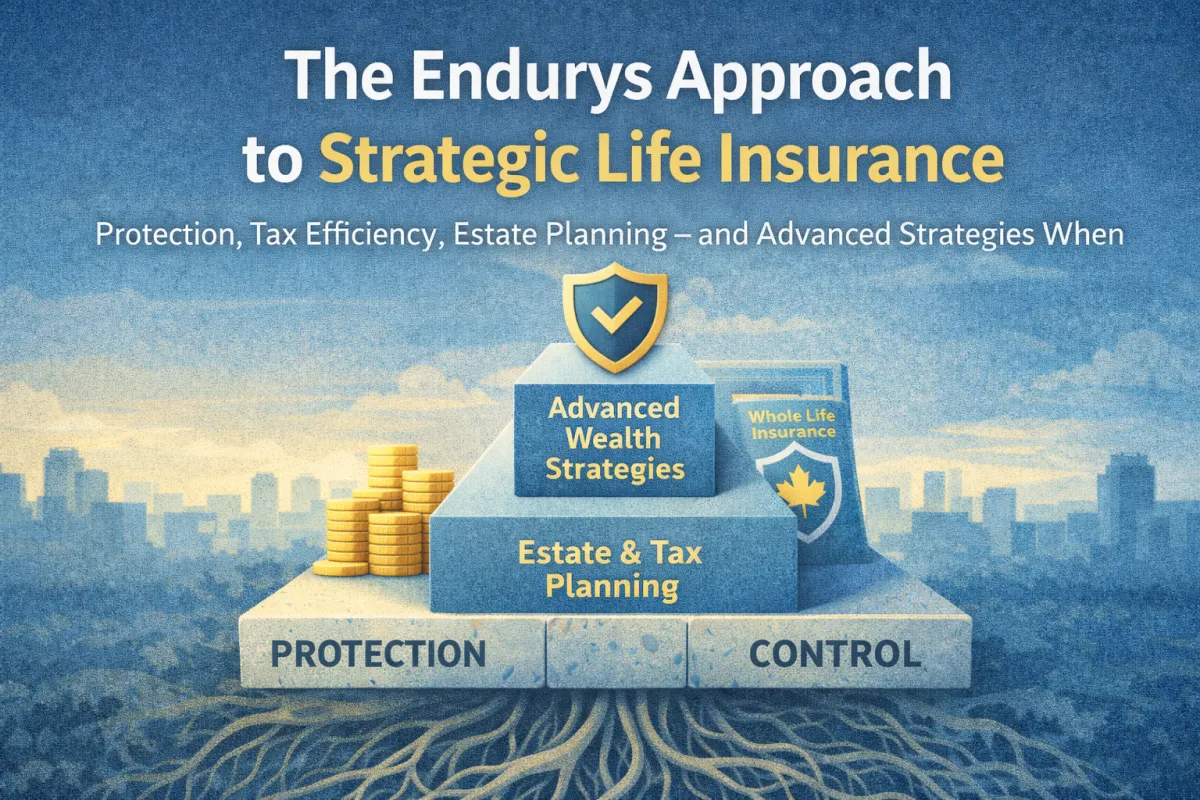

We believe life insurance should be designed, not sold. When the focus is only on the product, you are going to get a cookie-cutter solution to the very unique and one-of-a-kind situation that is you. We believe there are three levels to a strategically designed life insurance strategy. We approach life insurance as a piece that fits into the larger overall financial strategy. It should never compete with other financial goals. Done correctly, and strategically, life insurance becomes a force multiplier for your financial strategy.

There are three levels to strategic life insurance. Whichever level you end up with is totally up to you and your situation. The first level is protection planning. This is the core of what life insurance, and insurance products are about. The second level is estate, legacy and tax planning. The third level is Advanced wealth strategies using life insurance.

Level 1 – Protection Planning

This is the most basic level. The goal is protection for you, your family, or your business. At this layer, its all about efficiency and fit. The type of insurance, term, whole life, critical illness or disability will depend on the protection that is required. However, don’t get caught thinking that these products can’t be combined to provide protection that is greater than the sum of its parts. This is where the strategy comes in.

Protection needs change and fluctuate as your personal situation does throughout time. So too does the cost of insurance change as we age. Building layers into our insurance strategy provides flexibility in the event of a change. For example, a term life rider can be added to a whole life policy. This allows us to keep the cost of the whole life low by keeping the base coverage of the whole life small. Then we add term insurance to increase the total amount of protection for a much lower cost. Term insurance is temporary, depending on the term we choose, but it is a great, cheap way to provide protection when it matters most, say to cover the cost of a mortgage.

Here is where the strategic plan comes into place. Term insurance, with most carriers, can be converted into whole life insurance without medical underwriting. Why would we do this? Just like protection needs change throughout our lives, so too does our health. If you become uninsurable, this is a way to keep the back door open in the event we need more insurance later in life. It also becomes a gateway into the other levels should you choose to go that far.

Level 2 – Estate, Legacy, and Tax Planning

This is protection planning with longevity in mind, including future generations. It can be difficult to plan so far ahead that we are looking at what we want to leave to future generations, but that protection is best designed before we need it. Entering into these types of plans late means you pay a high premium to do so.

The last thing anyone wants is to leave behind a financial burden to their successors. Planning with longevity in mind, including final taxes, eliminates this risk without adding much cost. Insurance products can be designed to be extremely flexible. The goal behind the design is to cover all final expenses quickly and efficiently. Life insurance does this.

A death benefit bypasses the estate and goes directly to the beneficiary tax free. This means that we can plan ahead of time to cover the costs associated with the selling or transfer of assets. Designing flexibility into the plan to increase the death benefit over time allows us to grow into our strategic insurance plan on our terms. This is where time is important. If we could increase the death benefit by $20,000 every year, we can plan to have our estate coverage grow with us over time, without increasing the base cost of the coverage.

Let’s not forget the tax advantages that life insurance allows for. All of the accumulated growth within a policy is completely tax free. The death benefit is completely tax free. And any whole life product that has cash value, the accumulation of that cash value is tax free as well. Maximizing the utility of that cash value is what level 3 is all about.

Level 3 – Advanced Wealth Strategies Using Life Insurance

This is where the strategy turns from being passive to active. Level 1 and level 2 are about designing and implementing a strategy that integrates and synchronizes with your current and future financial desires and needs. Level 3 is about using life insurance to actively create wealth.

This encompasses the Infinite Banking Concept or what is sometimes called a personal, private or family banking system.

It is centered around the idea that the unique tax advantages and financing capabilities that exist within a participating whole life policy can be used to mimic the function of banking. This then allows you to take control of the banking function as it relates to your needs.

This level is less about life insurance, and more about a process to recapture the interest you are currently paying to lending institutions. Life insurance becomes a tool in this phase. It is still capable of providing protection and estate, tax and legacy planning, but it comes with an active side as well.

Not everyone will be ready for this stage, and that’s okay. What is important is leaving the door open to grow into this stage should you choose to. That is the foundational structure of strategic life insurance. The built in ability to grow throughout life without the need for additional underwriting and expenses. The goal is to create a strategy that fits now, but has the flexibility to adapt as you progress through life.