People often ask for spreadsheets, charts, and calculations to understand how being your own banker works. They want to know about interest rates, repayment schedules, and the exact figures involved. But Nelson Nash, the founder of the Infinite Banking Concept, simplifies it with a powerful analogy: If you owned a grocery store, would you shop at a different grocery store for your food? The answer is simple—absolutely not.

When you own a business, every dollar you spend within that business contributes to its growth and your profit. The same principle applies when you’re your own banker. Why would you funnel your money into someone else’s financial institution, allowing them to profit from your deposits, loans, and interest payments, when you have the opportunity to grow your own wealth instead? By using a Dividend-Paying Participating Whole Life Insurance Policy, you’re not just making transactions; you’re building your financial empire.

Every payment you make back into your policy is an investment in your own future. Just like shopping at your own grocery store supports your business, paying back your policy loan increases your wealth. The interest you pay doesn’t go to a bank CEO or shareholders—it goes back into your policy, enhancing the cash value available in the future and providing financial security. This process reinforces your control over your finances, ensuring that you’re the one benefiting from your banking activities.

Imagine the satisfaction of knowing that every dollar you spend is working to make you richer. You’re not just a customer in the financial system—you’re the owner. When you choose to bank with yourself, you take full control of your financial destiny, ensuring that your hard-earned money works for you and your family, not for someone else. To see how this works in real life, check out the screenshots below from my own policy loan repayment schedule, showing how this powerful concept turns every payment into a wealth-building opportunity.

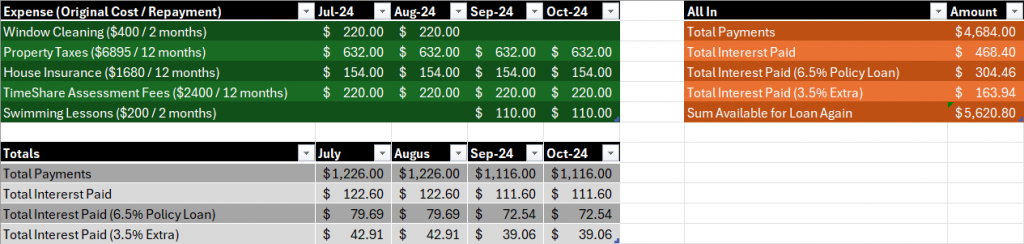

Here’s how I’ve organized it:

Green Section: This displays all of my outstanding policy loans and their repayment schedules.

Grey Section: This area contains the total amounts and interest calculations.

Orange Section: This section summarizes the entire year’s totals (not including policy growth).

This is a snapshot of my current policy loan repayment schedule. I’ve built this with a long-term perspective in mind, aligning my banking system’s fiscal year to start in November and end in October. When you look at how I’ve organized my policy loan repayments, you’ll notice the “interest” I’m paying. But what’s crucial to understand is that both the standard interest required by the insurance company and the extra contributions I plan to make are added back into the total loan amount. There’s another critical aspect to consider beyond this explanation, and I’m confident that once you reach that point, you’ll want to connect with us for further insights.

Leave a Reply